The GRIT report is the global market research industry’s defining trend report. It captures the perspectives of research industry professionals worldwide to distil trends in research usage, buying behaviour, the impact of technology, and the emerging practices that will define the future of research.

The latest report, released at the end of May, highlights the pace of change occurring in the industry and the need to stay open minded and nimble in testing new opportunities and tactics.

While considerable discussion focussed on AI’s impact on the industry, the report also identified some other fundamental challenges and opportunities.

Here are four things I learned that will be of relevance to market research professionals, marketers or salespeople buying research services.

1. Obsess about sample

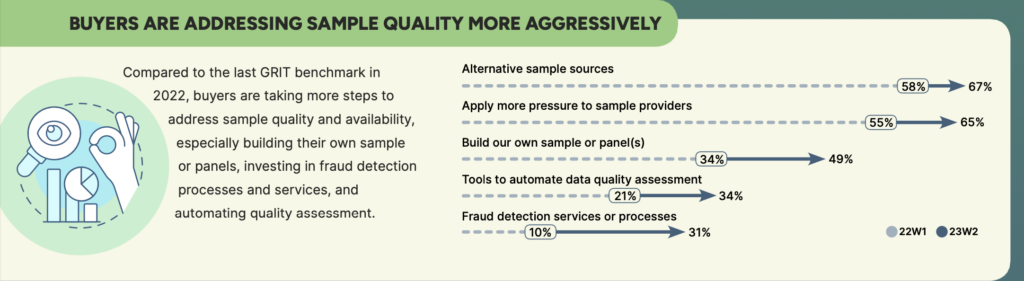

Compared to the last GRIT benchmark study conducted in 2022, research buyers are taking more steps to address the quality of the sample they rely on to inform their decisions. Nearly two in three research buyers undertake efforts in two key areas: seeking alternative sample sources and applying more pressure on sample providers to ensure sample quality. There’s also been a rise in buyers creating their own panels and using tools to automate data quality assessment and detect fraud.

This makes perfect sense in an environment where the rise of (AI-powered) bots is making it harder and harder to distinguish real people from clever machines.

Sample quality is very top of mind for my company. I’m the CEO of Glow, a research technology company that enables businesses to quickly and affordably capture insights from consumers, employees and other stakeholders. Many of our customers access respondents via our integration with over 40 panels that enable us to reach over 110 million people in 64 countries. When our customers plug into these panels they rely on us to ensure sample quality – we become the quality police.

Our internal analysis has identified massive variations in sample quality across different panel providers – some panels have up to three times as many ‘low quality’ responses as others, as defined by our proprietary assessment methodology. To ensure our customers aren’t paying for poor-quality responses, we have developed our own workflow using a range of in-survey and post-capture quality assurance methods that ensure our customers get quality data they can trust.

This issue will continue to be a focus for the industry as the panels and fraudsters battle to use technology to stay one step ahead of each other. If you are interested in this area, here’s an article from leading panel Dynata about the methods they use to ensure survey quality.

What does this mean for research buyers?

There has never been a greater need to be vigilant about sample quality. Ask your research partners about sample sources and the quality assurance practices that underpin their operations. After all, rubbish in means rubbish out.

2. Don’t believe the hype

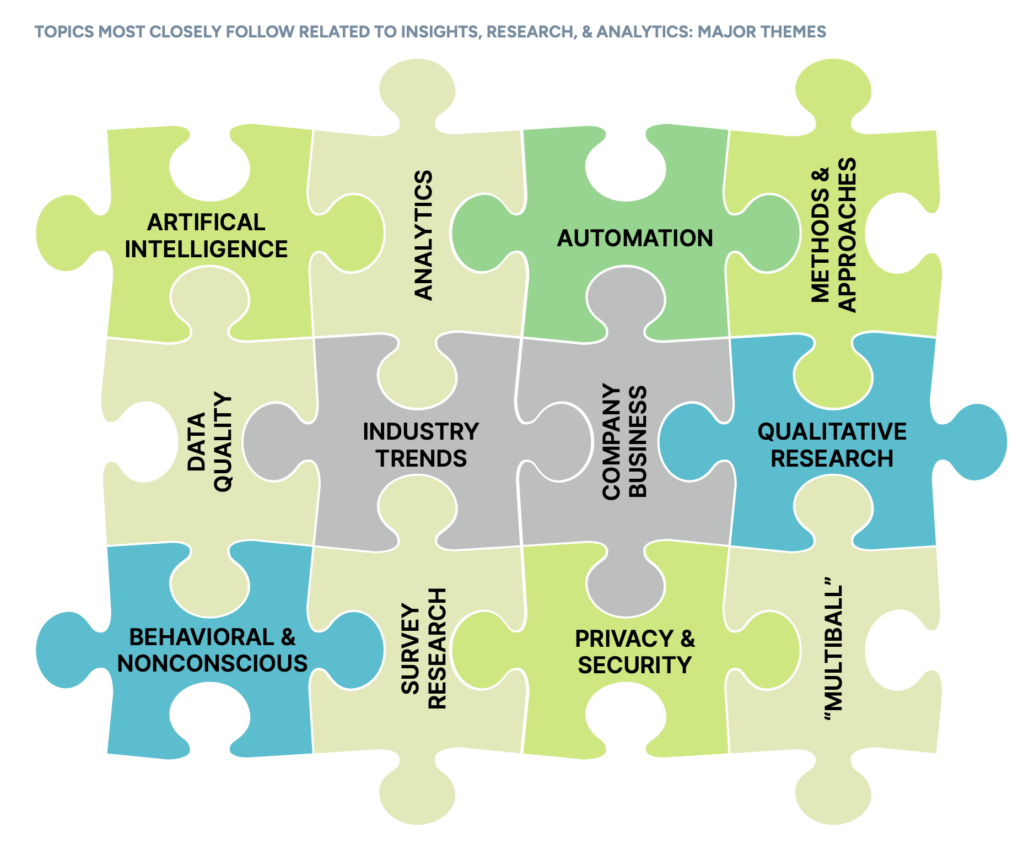

So many buzz words. So many of them include AI. And lots of them seem to converge around methodologies, analytics, and automation. The hottest topics of interest to the research community centre around insights methodologies and approaches, automation, tools and platforms, general and applied analytics and, of course, artificial intelligence. All of these things seem to be tightly interconnected.

As the author of the GRIT report Leonard Murphy highlights, the common goal seems to be efficiency.

“Enabling and augmenting capabilities are important, as well as improving the impact of insights, but the need to do more faster is a constant companion.”

What does this mean for research buyers?

Don’t believe the hype. While AI might be the centre of the buzz, quality research only occurs when all the building blocks are in place. In the case of quant survey research that means solid methodologies, effective questionnaire design, quality data, robust analysis and actionable insights. AI might augment some or all of those elements, but it doesn’t replace them. This means that more than ever, testing is the best path to risk reduction and better decision making.

And when it comes to ‘doing more faster’ it is worth remembering that online survey platforms are designed to do just that. They’ve been built on automation and machine learning, prior to the AI buzz, and they’ve been designed to capture robust data quickly. They can be a powerful addition to your research arsenal for important but not mission-critical decisions. Platforms like Glow, Survey Monkey, Attest and others are built to deliver quality data in hours or days, for common research use cases where the board needs a decision not a hundred-page report.

3. Method matters

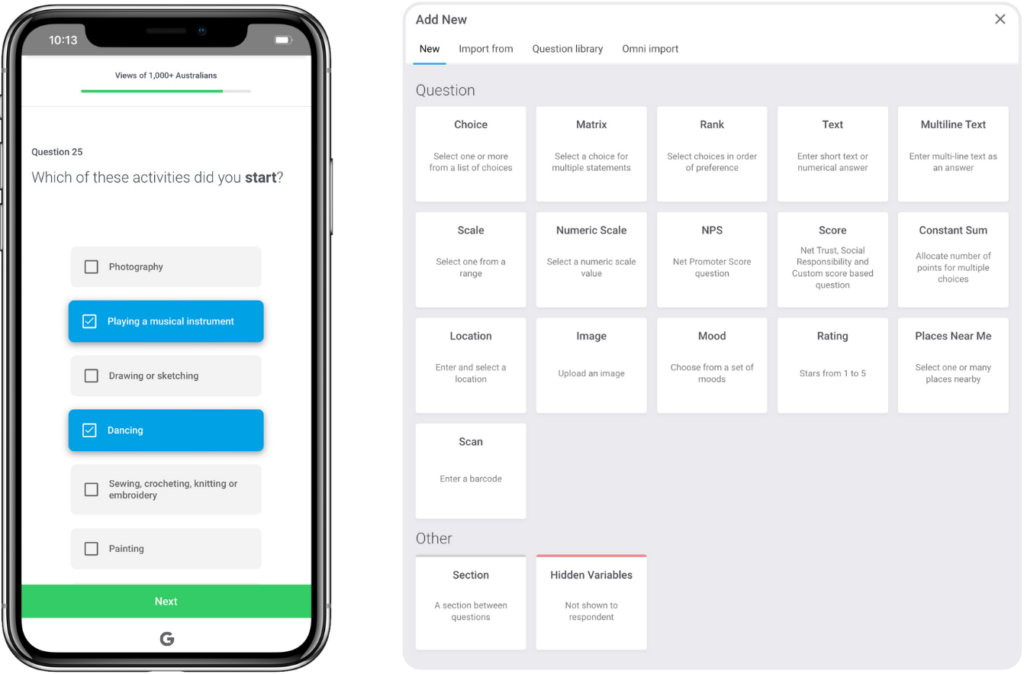

Surveys, focus groups and in-depth interviews remain the foundation of the insight industry.

And online surveys, given their versatility, speed, and affordability remain the bedrock. As the report points out:

“In all eight of our buyer and supplier segments, not only do most insights professionals use online surveys, most of them use them regularly.”

The data also showcased the use of ‘mobile first surveys’ by 69% of research buyers, up 5% on the previous report and the strongest growth area amongst this segment.

What does this mean for research buyers?

If you’re not already using online surveys as a part of your research mix, then it is time to start. But before you do, take a moment to match your needs with potential partner capabilities – ask questions about how they source sample, their quality assurance practices and whether the survey tech itself is mobile first, especially if you want to engage with younger audiences.

4. Demand better

Each GRIT report looks at the top criteria insight professionals use

to choose suppliers or partners. In the latest report, they presented the methodology criteria as a trade-off and removed the no-brainer “quality of insights generated” as a criterion.

Top 4 factors in partner/supplier selection

| Buyer – Research | |

| Data Quality | 80% |

| Service Quality | 73% |

| General pricing | 51% |

| Reputation | 39% |

| n= 105 |

Source: 2024 GRIT report

The findings show a similar result to previous years, where buyers are demanding ‘cheaper, faster, and better’. But this year ‘better’ dominates – buyers are obsessing over both data and service quality.

What does this mean for research buyers?

It isn’t surprising that quality is at the forefront of everyone’s minds, because quality directly affects the impact of research.

No one ever asked for cheap and poor-quality research.

Again, this reiterates the importance of understanding any supplier’s source of sample as well as assessing the quality of the service they offer.

For service, that means checking out testimonials, case studies and reviews on independent sites like G2 or even asking to speak to other customers about their experience with the supplier before you commit.

The best option will always be to try before you make a long-term commitment. For example, Glow offers customers self-service or managed solutions that don’t try to lock them in before they’ve seen the value of the service. We can do that because we know we deliver – our 2024 NPS is 77.

For me, the key learnings from this report are about pragmatism. The research world is changing fast, and the amount of buzzword bingo is only going to increase. The best way for research buyers to get what they need is to assess partners rigorously around the key building blocks of data quality, service quality, and value. And as you do with any research project, test before you invest.

Tim Clover

Tim Clover is the founder and CEO of the research technology platform Glow.

Glow’s research tech, audience access and support services enable marketers, salespeople and researchers to capture insights easily so they can make better decisions faster.

To learn more about how Glow can help your business, book an intro today or sign up for free and test the platform yourself.