This post provides updated data highlighting the brands seen as sustainability leaders by consumers in the UK, US and Australia. It is based on a sample of over 25,000 respondents, rating 494 brands across 3 markets from July to December 2024. It showcases shifting consumer opinions and identifies the brands gaining (and losing) credibility.

The sustainability advantage

How sustainable your brand is seen to be influences whether consumers choose you versus comparable products. Your sustainability creds won’t bridge a major price gap or a quality issue, but even in these turbulent times, more than 4 in 5 consumers care about people and the planet – believing it is important that businesses act in a responsible way.

Caring counts. Brands seen to be making an effort will be chosen more and more often over functionally similar brands. For example, 31% of Gen Z respondents to a recent survey claim to have either stopped, started or switched buying a brand in the last 3 months due to the brand’s social and environmental behaviour.

But it’s not just about attracting customers. Businesses with a serious commitment to ESG are also magnets for talent, particularly among younger audiences.

Nearly as important as doing good is telling people about it. A report from 3BL & Triple Pundit, with data provided by Glow, revealed that nearly 70% of US consumers want more communication from businesses about their sustainability efforts because people just don’t know what businesses are up to.

This post highlights brands that are doing good and communicating effectively, using data from Glow’s unique Social Responsibility Score® (SRS) metric. SRS measures consumers’ perceptions of how socially and environmentally responsible a business or brand is. These perceptions are benchmarked across categories, countries, audiences, and time. Over the past three years, Glow has monitored hundreds of brands in three markets: Australia, the UK, and the United States.

The following analysis highlights some of last year’s winners and losers. It showcases the top brands measured from July to December and reveals which brands improved their perceptions and which lost their sustainability shine.

The analysis shows that tough economic conditions, shifting market dynamics, uncertain political environments and evolving consumer priorities have significantly affected many big brands and created opportunities for others.

Read on for a breakdown by market.

Australia: Supply chain gains

Sustainability-focused brands Who Gives A Crap and Earth Choice continue to top the scoring in Australia, while Sanitarium, Lipton and Cadbury enter the top ten.

Sanitarium has a broad range of sustainability initiatives spanning community support and environmental harm reduction, while Cadbury and Lipton are particularly active in championing sustainable sourcing programs with farmers.

Outrage over perceived supermarket price gouging and the resultant investigation by the Australian Competition and Consumer Commission (ACCC) saw the reputations of Woolworths (down 73 places) and Coles (down 58 places) plummet in the first half of last year. With less (negative) media attention, they’ve recovered ground in H2 (Woolworths climbed 45 places, Coles 27), but their reputations remain tarnished, and their credibility is well below 2023 levels.

ALDI’s star continues to rise – it remains the top-ranked supermarket and has climbed an additional 32 places in the last six months to sit just outside the top ten at number 12.

Community-connected retailers Bunnings, Chemist Warehouse, and Officeworks have held strong positions in consumers’ minds, though Officeworks has slipped six positions to just outside the top ten due to gains by non-retail brands.

Over the last six months, the superannuation sector has experienced several large shifts in perception. Aware Super rose 90 places to number 38, while greenwashing accusations against Australian Ethical caused damage, dropping it 31 places in the rankings.

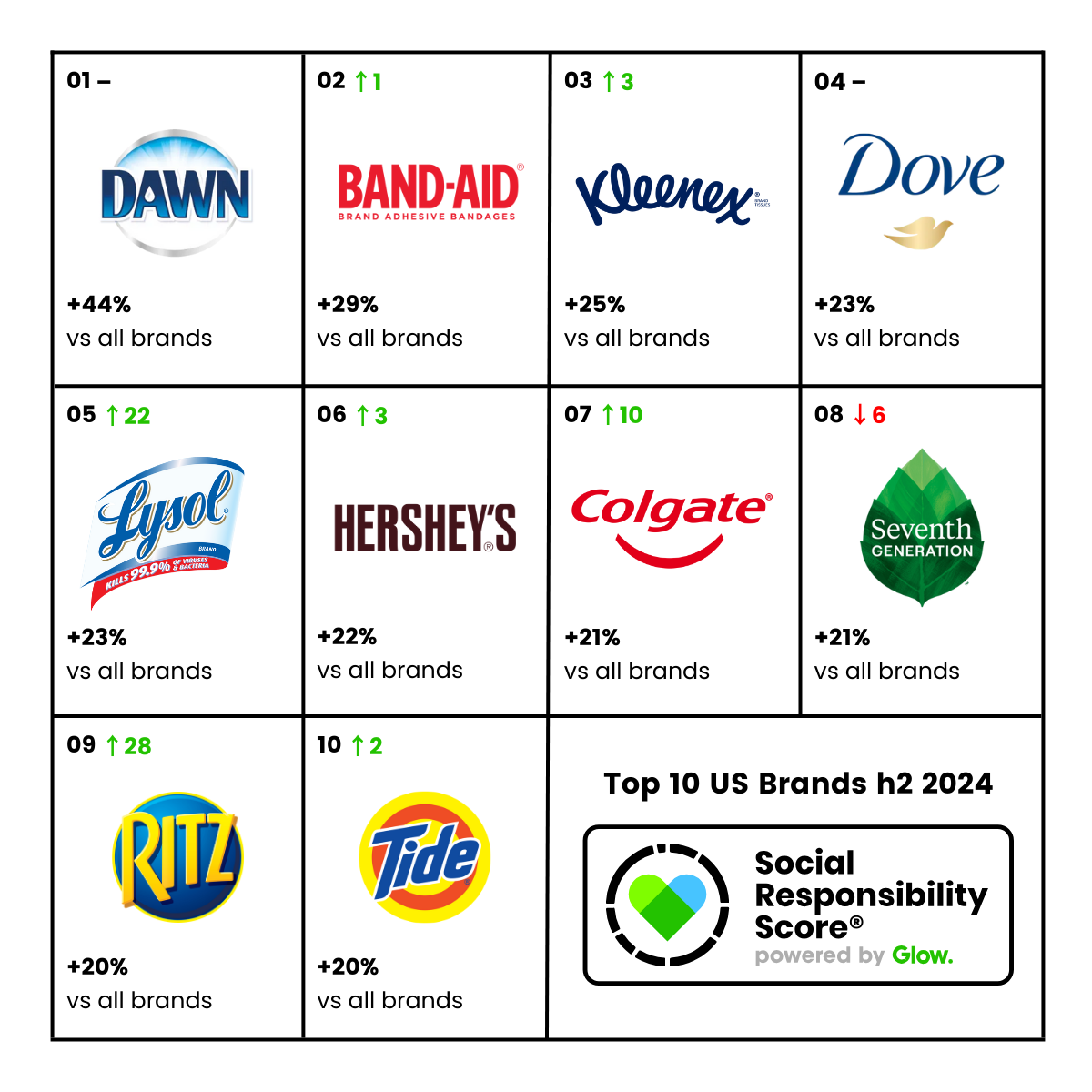

US: The bounceback

The top brands seen as most socially and environmentally responsible, remained similar to the rankings in H1 2024, though Lysol & Ritz entered the top ten at the expense of Amazon and Campbell’s.

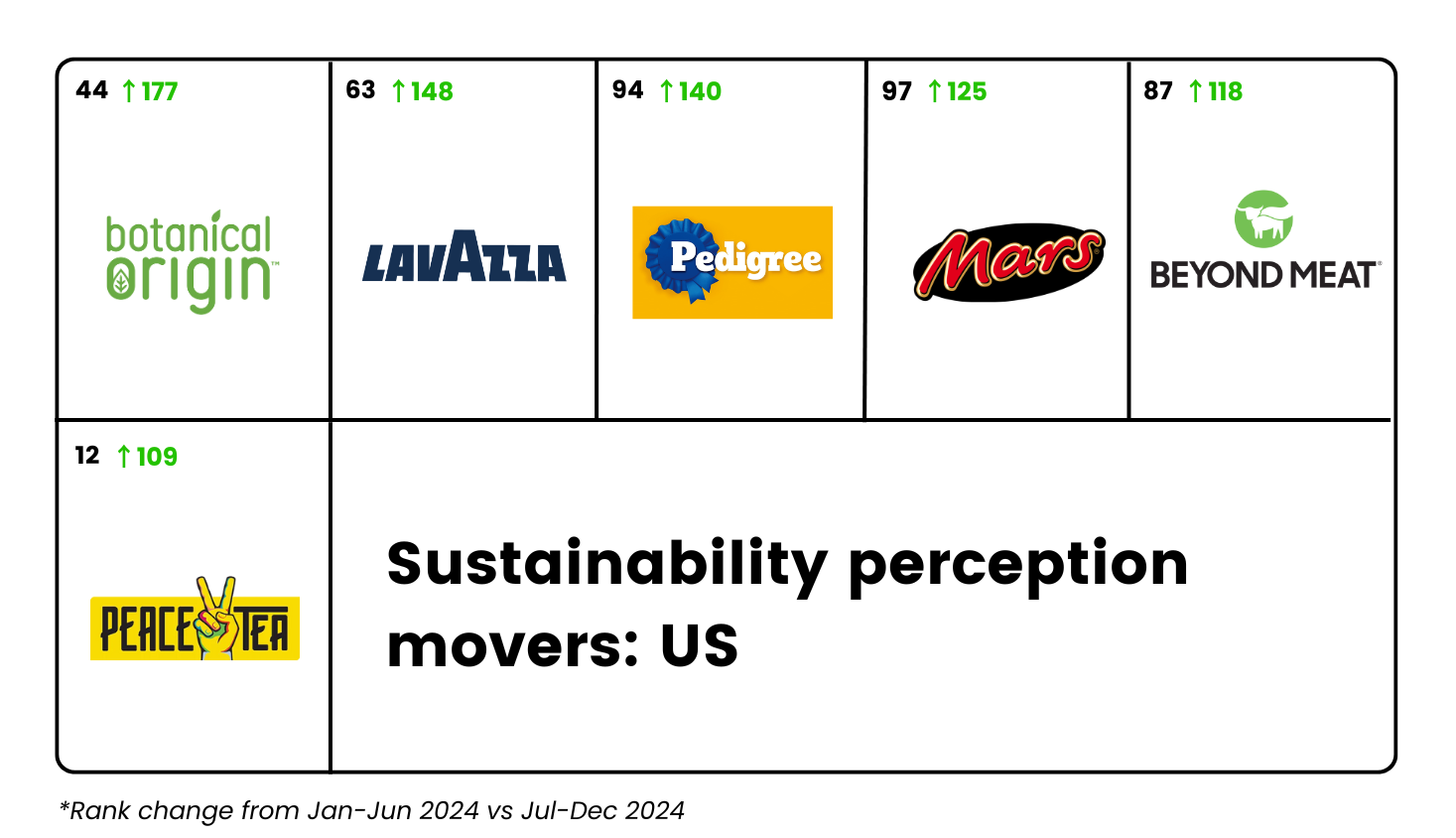

There were a number of movers further down the rankings. Firstly, the swathe of premium(ish) environmentally or socially conscious brands that fell away during H1 2024, such as Beyond Meat, Botanical Origin, and Peace Tea, have improved perceptions in the back half of the year.

The biggest movers were household cleaning brand Botanical Origin (+177 places), coffee brand Lavazza (+148 places), pet food Pedigree (+140 places) and Mars (+125 places).

Lavazza is making progress through a combination of initiatives addressing its supplier farmers’ educational, economic, and infrastructure needs, and through programs recycling industrial waste, reducing carbon footprint, and developing sustainable packaging.

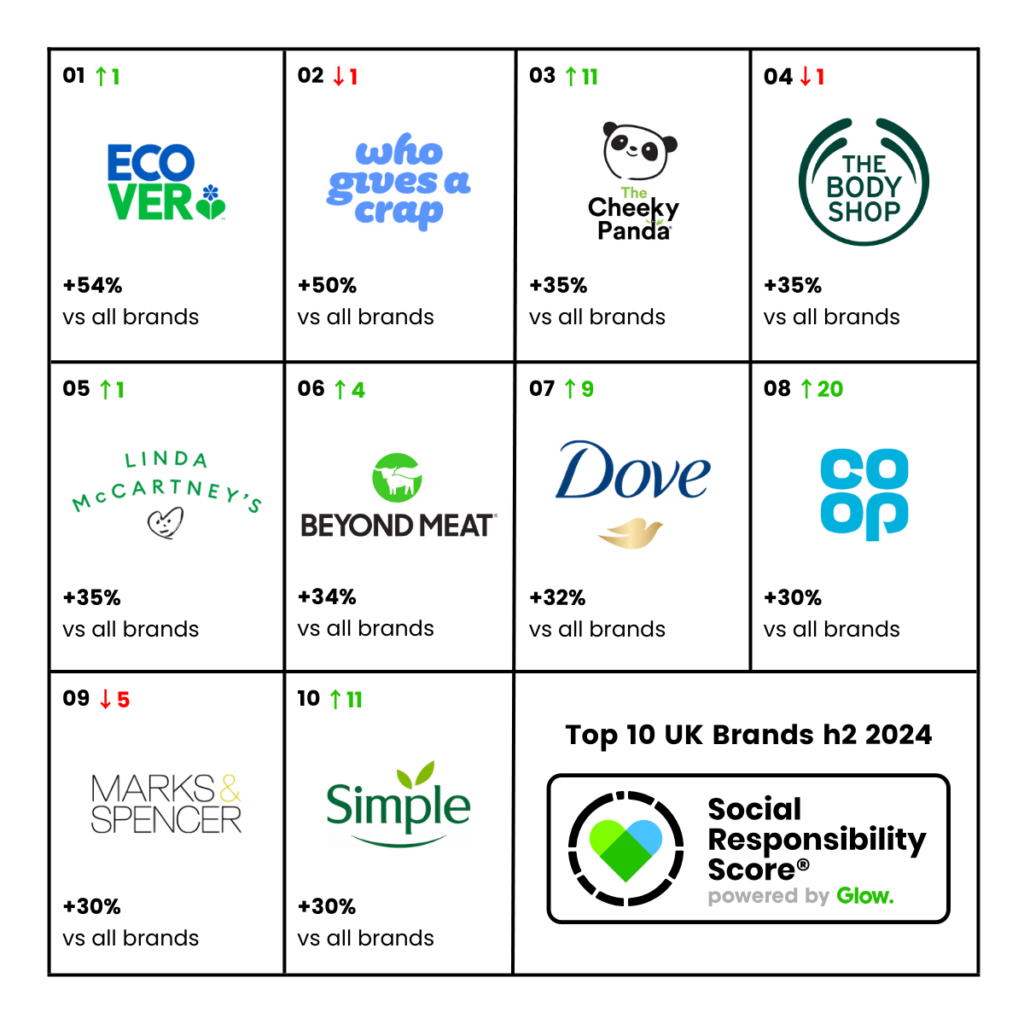

UK: Sustainability leaders hold strong

The leading brands remain consistent in the UK market, with little movement in the top twenty brands other than the entry of community-focused supermarket chain Co-Op into the top ten (up 20 places).

The big mover in the UK, like the US, is plant-based cleaning product Botanical Origin, which has jumped 92 places to the number thirteen spot. This Reckitt owned product adds to the list of ‘household category’ (cleaning and paper products) brands that resonate with consumers. Sustainable brands in this category punch above their weight by addressing environmental harm reduction and social good, in a way that addresses top of mind consumer concerns.

Data:

This data compares brand performance from Jan-Jun 2024, with the period Jul-Dec 2024. The brands represent a cross-section of major brands from over 20 B2C industries, with responses from a nationally representative sample of more than 11,500 consumers in each market captured via Glow’s Social Responsibility Score® tracker.

Reference & further reading:

Sustainability-related reports – all free to access:

- The 2024 Consumer Insights & Sustainability Benchmark Report – published by 3BL/Triple Pundit

- The 2024 Size of Prize Report – outlining the $44Bn sustainability opportunity across 12 U.S. industries.

- US/UK/Australia Food & Grocery Sustainability reports – industry specific insights into the issues most relevant to consumers, how to comnnuicate sustainability actions and which brands are leading the way.

- Brand specific sustainability rating scores – over 700 sample brand reports using the SRS metric to highlight brand performance relative to competitors.

If you’d like to talk to someone about measuring perception of your brand’s sustainability performance book an intro meeting here.

Written by a real person, editing assisted by AI:

Mike Johnston

Managing Director of Data Products at Glow