Mike Johnston argues that food and grocery businesses are squandering potential profits by not embracing sustainability. He draws on recent research data to outline how to dismantle barriers to consumer action and unlock revenue.

Nine billion reasons to be socially and environmentally conscious

Embracing sustainability isn’t just a moral imperative for businesses. It’s a pragmatic necessity. Those businesses that continue to invest stand to reap a plethora of rewards, from improved employee engagement to enhanced consumer loyalty. And this isn’t an either-or scenario that pits product against purpose; it’s about harnessing ESG efforts to drive performance, creating a win-win situation where companies can make a positive impact while seizing lucrative commercial opportunities.

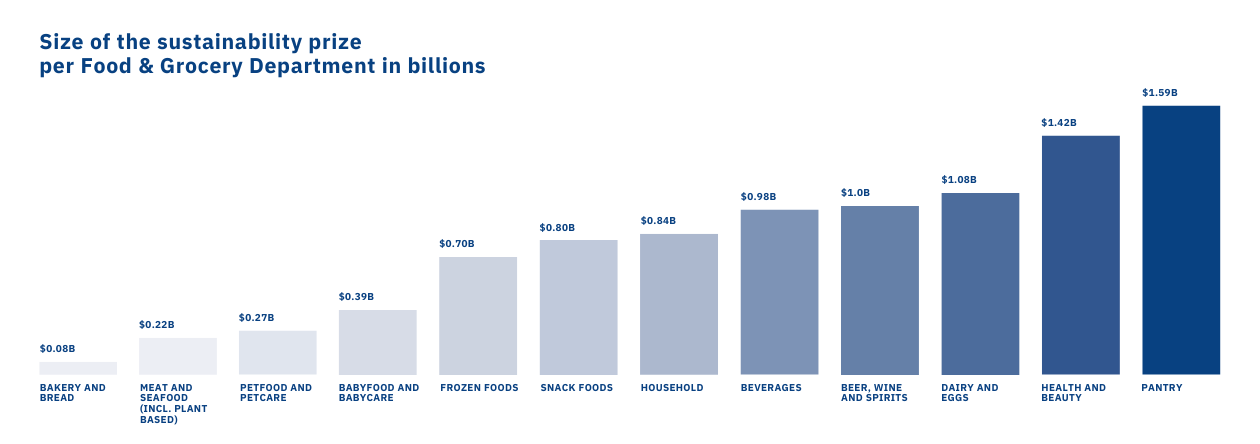

If that feels like a bold assertion to you, then take a look at the recently published Size Of Prize research report. It estimates that this year, more than $9 billion of U.S. consumer spending on food and groceries will move away from brands with a poor reputation in terms of sustainability and towards brands that are perceived as leaders in this area. I should mention that Glow, the research technology firm I work for, produced the report in collaboration with TriplePundit and 3BL Media, and supported by Cint.

Whilst this might seem like a big number, it will only increase. In the same study, almost 60% of consumers stated that they anticipate social and environmental factors to have a greater influence on their food and grocery choices in the upcoming year than in the present.

Food and grocery leads but barriers remain

The food and grocery sector is seen to be leading the way in sustainability – consumers rank it in the top three most sustainable industries – but that doesn’t mean all brands are doing brilliantly, or all consumers are purchasing sustainably.

How important is sustainability really?

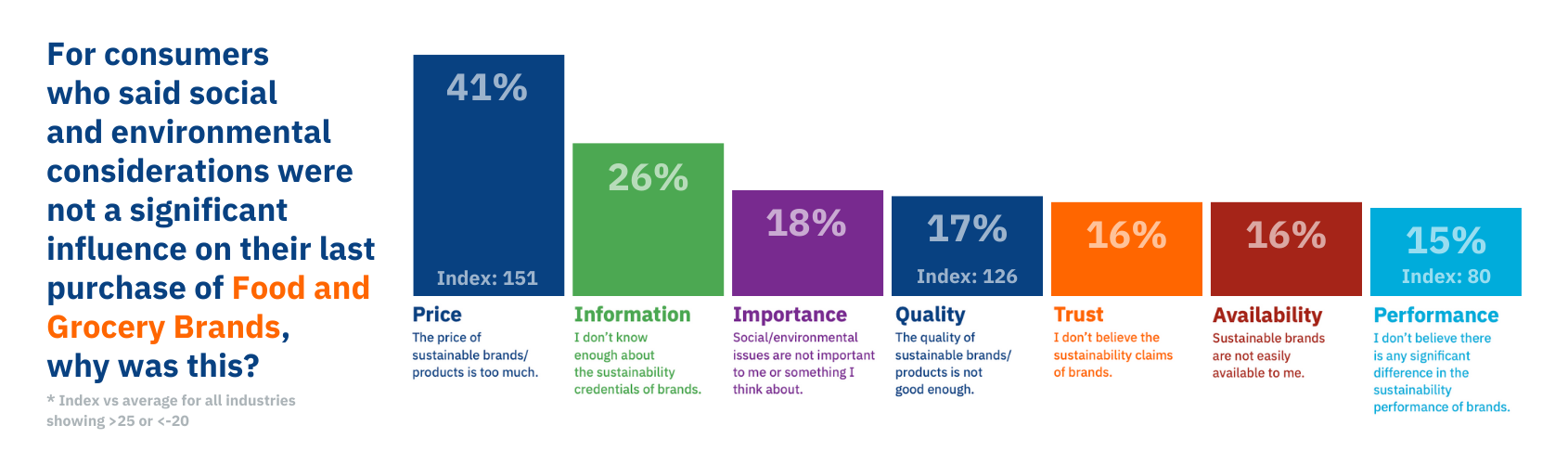

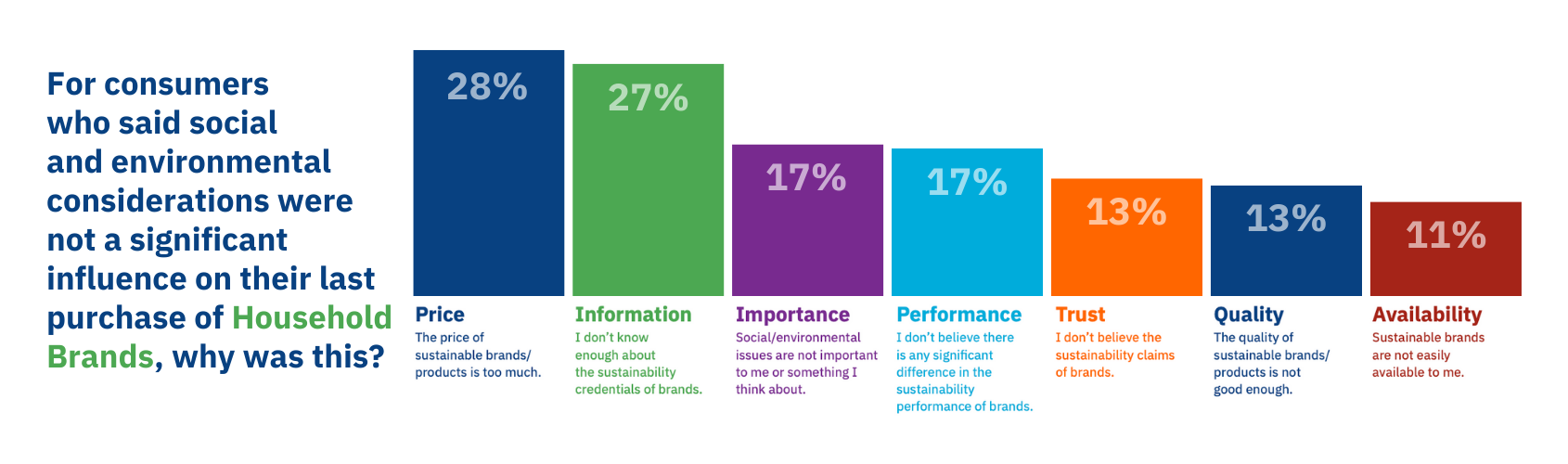

Four in 10 consumers say that sustainability considerations had a “significant” influence on at least some of their product choices within their last grocery shop, according to the Size of Prize report. Price was the key barrier amongst those for whom sustainability wasn’t a serious consideration while grocery shopping. This is not surprising given the current cost of living crisis and the huge impact grocery bills have on overall household budgets.

Two other barriers to more sustainable choices stand out. Information is the second largest choice barrier — people say they don’t know enough about the sustainability credentials of brands to judge them. This is clearly a communication issue, highlighting the importance of promoting your positive actions if you want people to choose you over other brands. Quality concerns are the other interesting area that is disproportionately higher in food and grocery versus most other industries. People worry whether sustainable products will functionally deliver to the level they expect. For example, will plant-based meats taste as good, or eco-friendly cleaning products clean as effectively? Quality concerns can be mitigated by experience, requiring brands to stimulate trial and demonstrate social proof, tasks underpinned by strong communication.

The food and grocery industry covers a wide range of products across which decision criteria vary greatly. So, let’s explore the influence of sustainability further by looking at some specific departments.

Health & Beauty

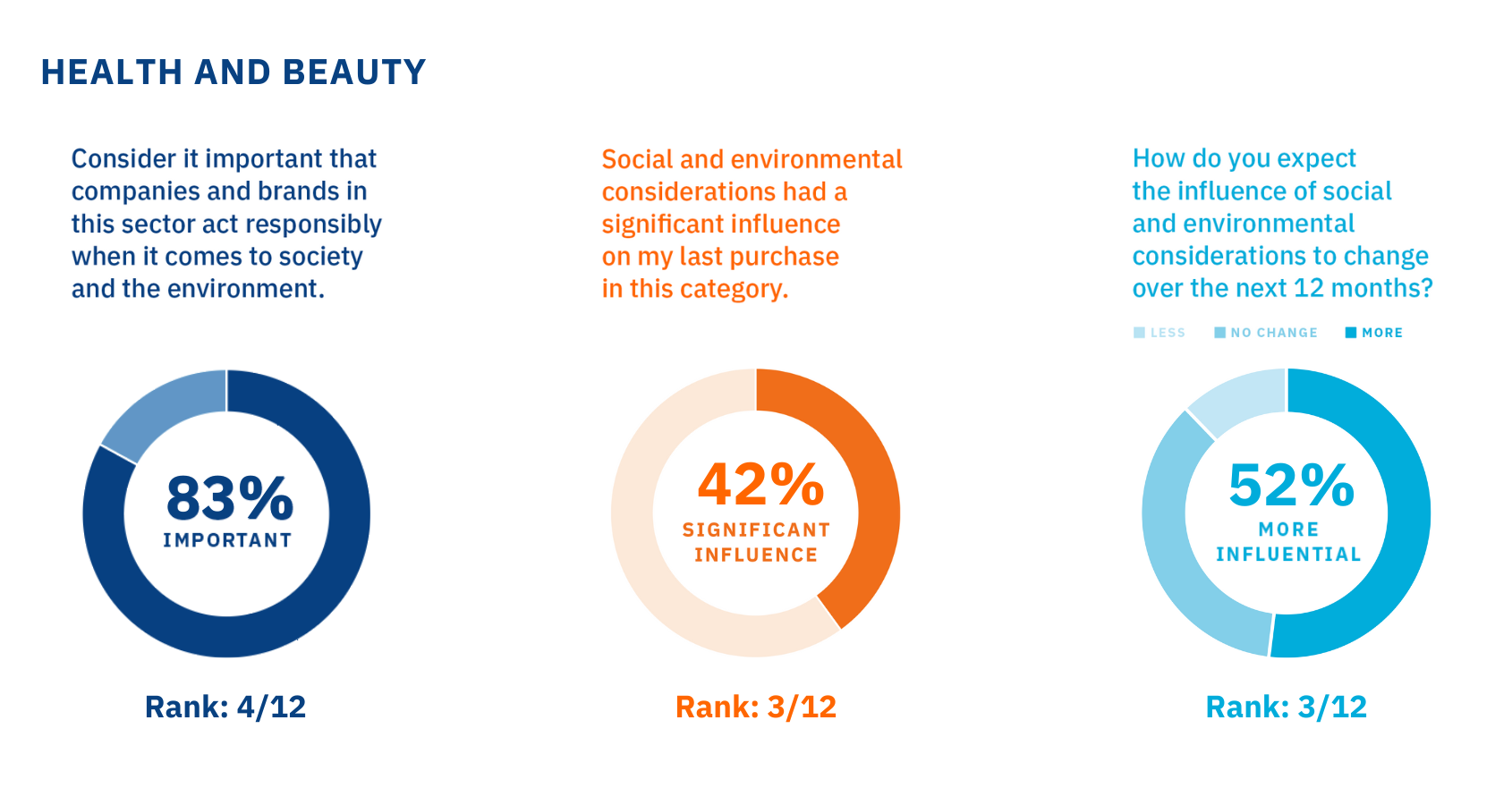

Health & Beauty (H&B) is one of the categories with the largest sustainability size of prize, valued at $1.4 billion. This is reflected in the high importance and impact on purchase decisions consumers report for the category. And this is only likely to grow over time with the majority of consumers expecting sustainability to have a greater impact on their purchases in H&B in 12 months, while only 1 in 8 expect it to reduce.

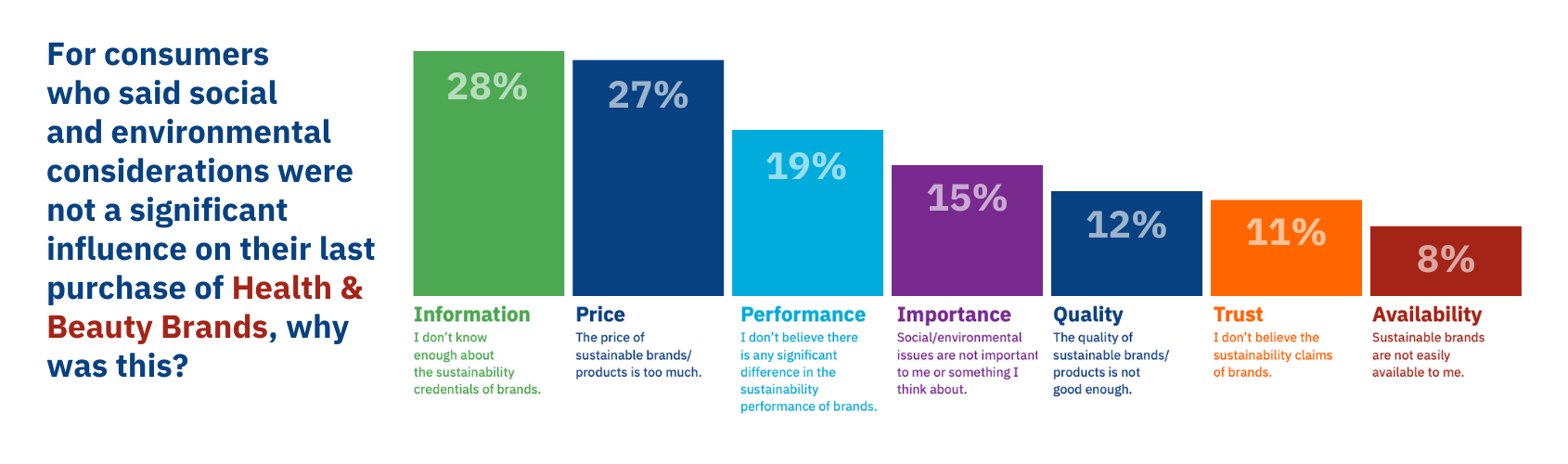

As previously discussed, price is a major barrier to consumers making more sustainable choices across the food and grocery sector, but it is not the most significant factor for every category. For instance, Health and Beauty is a prominent exception with a lack of information on the sustainability credentials of brands being the leading barrier to more sustainable category choices.

In addition to the key barriers to sustainable purchasing of a lack of information there is a disproportionate concern in the category that all products are the same when it comes to their sustainability efforts. Both of these issues present a clear opportunity for brands to communicate more effectively with the market, showcasing what they are doing in this space, the impact it is making, and how it differentiates them from their competitors.

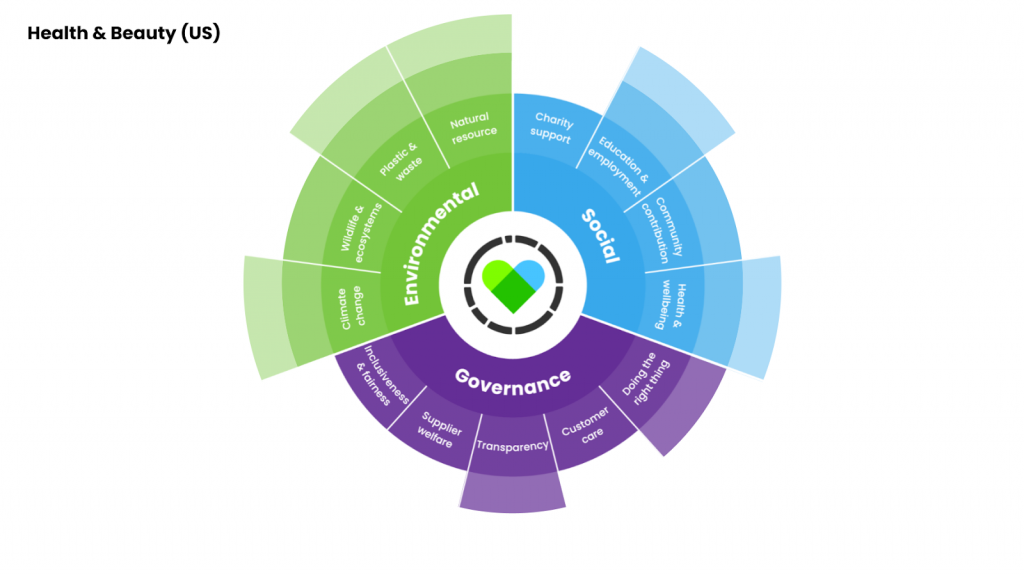

So, what drives sustainability credentials within H&B? As part of the Social Responsibility Score (SRS) system, Glow identified 13 drivers across ESG (Environment, Social, and Governance) that impact perceptions. The two largest drivers for this category are environmental – ‘Reducing Emissions & Climate Change’ and ‘Respecting & Protecting Natural Resources’ – and brands in general are seen to perform poorly in these areas. Two drivers are more important in this category versus food and grocery in general, these being ‘Caring About My Health & Wellbeing’ and ‘Reducing Plastic and Managing Waste’.

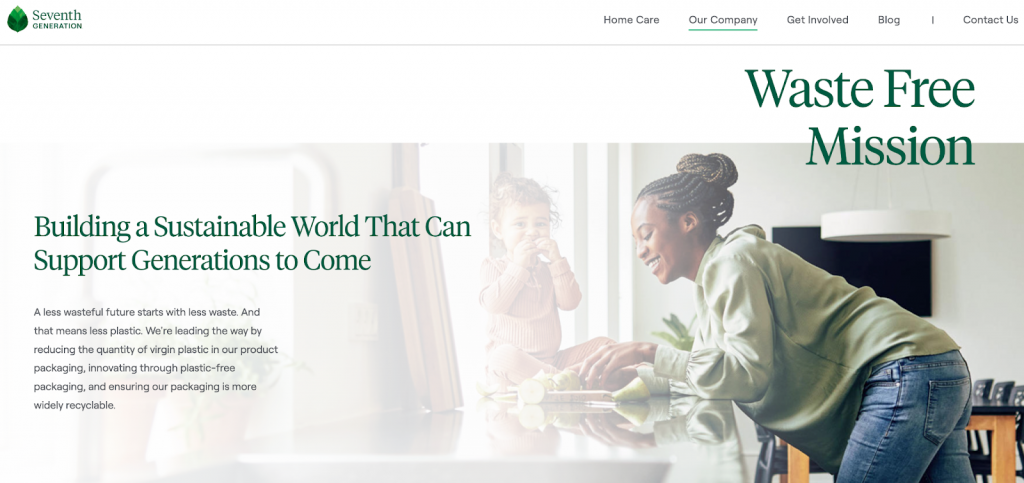

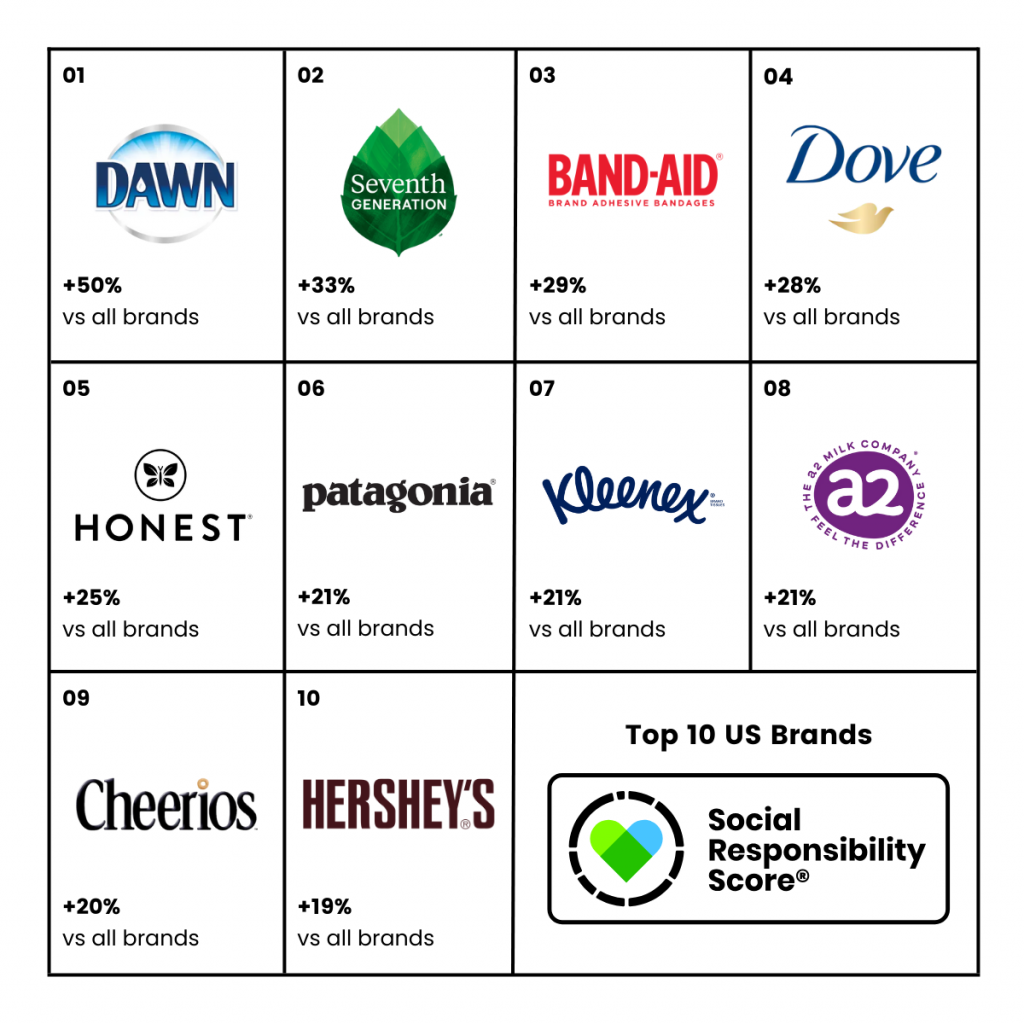

Focussing on the right areas makes a difference. The brands seen as leaders by consumers address the key areas. Seventh Generation and Love, Beauty & Planet (top twenty SRS brands) focus on communicating their environmental efforts, while Dove (also top 10) champions female empowerment, aligned with the Health & Wellbeing driver.

Household

Like H&B, the household category is one of the top categories for sustainability’s importance, purchase influence, and impact on brand switching. The size of prize for more sustainable brands in this category is an estimated $840M.

Price is the single largest barrier to more sustainable choice, but is trailed only slightly by a lack of information. Tied to that, there’s higher-than-average skepticism around sustainability claims made in this category. That poses a different challenge for brands operating in this space – they need to use proof of their ESG impact as the springboard for more communication in order to convince consumers they are authentic, transparent, and truthful in regard to their sustainability journey.

Environmental drivers dominate, occupying the top four positions in terms of importance in impacting perceptions. ‘Reducing Plastic & Managing Waste’ is a stronger driver of sustainability credentials than in other categories.

Given how important environmental efforts are for this category, it is not surprising to see that Dawn is considered the most sustainable brand by consumers (from amongst over 200 brands across 14 categories), according to Glow’s SRS data. Dawn is committed to using environmentally friendly product ingredients, recycling plastic and reducing water use and has longstanding partnerships with several wildlife charities. These efforts align perfectly with key consumer concerns and Dawn actively communicates both their efforts and their impact to consumers.

Pantry & Beverages

Both pantry and beverages departments are ‘mid-table’ in terms of the importance of sustainability to consumers and the influence it has on purchasing choices. However, because the category spending is large, it means that the sustainability size of prize is still huge – over $2.5Bn combined opportunity ($1.6Bn and $1Bn, respectively) – for the brands willing to promote their sustainability credentials.

For both categories, information and price are the top two barriers to consumers’ more sustainable choices. Interestingly, there is also an ‘Importance’ barrier in these categories, especially beverages — some consumers simply don’t see sustainability considerations as important. This reinforces that strong sustainability credentials aren’t essential to win a share in categories like beverages. Still, brands positioning around sustainability are gaining a share from the growing cohort of consumers who do care.

This polarization is evident in SRS for brands within these categories — Cheerios, Heinz, and Quaker all appear in the top 20 SRS brands for 2023, while a number of their competitors score in the bottom half of the brands being tracked.

Regarding what drives sustainability perception, ‘Health & Wellbeing’ considerations jump in importance for the beverages category due to concerns around sugar content in soft drinks. The pantry category largely mirrors the general F&G trend, such that communicating your environmental actions around ‘Climate change’ and ‘Protecting natural resources’ will have the most significant sway on consumers.

Creating commercial advantage

It’s evident from the data that sustainability is becoming increasingly important for consumers when selecting brands, even in the current cost of living crisis. The data also shows that there is already a significant commercial opportunity for brands that are leading the way in most F&G categories.

However, brands can only capture the hearts and wallets of consumers by communicating their sustainability efforts and impact transparently and truthfully. It’s essential to filter communication through the lens of what matters to consumers, which varies by category. Not communicating about sustainability efforts, or “greenhushing,” can result in losing out on consumer loyalty and revenue to competitors. Brands investing in ESG/sustainability programs deserve to reap rewards for their efforts. Are you getting the prize you deserve?

Data sources:

This article draws upon Social Responsibility Score (SRS) data produced by Glow across various studies and from its ongoing tracker. Food and grocery department purchase intent and switching data are sourced from a Glow study conducted in November 2023, in which we surveyed a nationally representative sample of 3,194 US respondents. We gratefully acknowledge Cint’s support in providing respondents for several studies referenced in this article.

Sample brand reports – reports providing real data for over 700 brands are available for free via the Glow portal.

About Glow:

Glow is a research-technology business that provides survey software and produces data products, including sustainability diagnostics and tracking solutions. To understand your brand’s sustainability position relative to competitors, visit the website or contact Glow at srs@glowfeed.com.

Written by:

Mike Johnston

Managing Director of Data Products at Glow.