The pandemic has drastically changed the way we travel, but the industry is bouncing back, and there’s never been a better time to reassess how you can capitalize on this revival. In this article, our team shares their top 5 research tips for unlocking better quality and more actionable insights for travel and tourism providers and their agency partners.

People are travelling again

Travel is essential to GDP for most developed (and some emerging) markets. According to World Travel and Tourism Council data, the Travel & Tourism sector contributed 8% to global GDP in 2022, up 22% from 2021 and only 23% below 2019 levels. The industry also created 22 million new jobs, representing an 8% increase in 2021 and only 11% below 2019.

It is clear that the sector is an important growth driver for many economies, and the good news is that travel is bouncing back.

But the world is not the same as it was. Covid-19’s economic and social fallout continues long after most people have overcome the physical effects. And the consequences have been enormous for the world of travel.

The travel & hospitality sector was one of the hardest hit by Covid, and many things have changed while the bounce-back is underway. Many operators, airlines, and sector service providers have dramatically changed their offerings or been forced out of business due to a lack of tourists.

Consumer behavior changed dramatically because people couldn’t travel then and were too scared to. But even with most markets opening up, travel dynamics have changed, and so has the way consumers plan, book, buy, and experience. For travel and tourism providers of all kinds, you can’t assume what you did pre-Covid will continue to work, or your audience is still the same. Instead, as spending returns, now is the time to assess the changed dynamics of the travel market to ensure you capture your share of the bounce-back.

And that’s where effective market research can help. Gathering some reliable research data can enable travel and tourism providers to answer questions like:

- Are my key segments the same as pre-pandemic? How did they make decisions? Are they traveling differently?

- Who are my competitors now?

- Is my product still fit for purpose?

- Do my communications still resonate?

Getting answers you trust will inform critical business decisions around products, partnerships, and marketing that can be the difference between surviving and thriving. By investing a little upfront, operators can avoid wasting money by getting segments, products, or marketing wrong.

Glow’s team are expert in helping travel and tourism brands understand their travel audiences, reveal their motivations, and motivate them to travel.

Our team has over 30 years of collective travel and tourism experience undertaken worldwide for brands including Tourism Australia, Visit Victoria, Destination NSW, Hertz, Qantas, Jetstar, Booking.com, and more.

In this article, we asked them to outline some specific considerations and recommendations to ensure that travel players can use quantitative market research effectively to capitalize on the resurgence in travel and grow their business.

5 tips for better travel and tourism market research

1. Talk to the right audience

It might sound obvious, but you won’t get the correct answers if you don’t talk to the right audience. And that means starting with the source of your research data. The kind of travelers that many businesses want to speak to are cash-rich, time-poor, and geographically mobile. That means pinning them down to provide their opinions for consumer research can be challenging. It often requires working with partners that can source respondents from multiple places to ensure a robust and representative sample of your desired travel audience.

At a more pragmatic level, you also need to sense-check how your audiences are asked to provide their opinions. For example, younger and more affluent travelers and those in certain countries will be highly mobile-centric in their internet access, so your research platform UX needs to reflect that. Getting trustworthy and quality data from them depends on fitting the research experience into their lifestyle, enabling them to respond naturally and efficiently on their mobiles on the go.

Platforms like Glow take a mobile-first approach to survey experiences that, when combined with multi-stage data quality assurance, provide data you can trust across all desired consumer groups.

2. Re-assess your market regularly

The global economic impacts of the Covid-19 pandemic continue to be felt, and the travel & tourism sector was one of the hardest hit. After a decade of steady growth in passenger traffic, air travel was decimated. The International Air Transport Association (IATA) expects overall traveler numbers to return to pre-pandemic 2019 levels in 2024, but some parts of the industry will never bounce back.

Large numbers of tour operators, travel agents, and tourism destinations, along with some airlines and hotel chains, went bust, creating further disruption that will last for years. In addition, household brands disappeared, like the world’s oldest travel company Britain’s Thomas Cook, ignoring the social and economic impacts of those business failures in their local communities, the effect on consumer choice is enormous.

Consumers have been forced to reset their choices in many areas of travel – some brands they knew and trusted can no longer help them plan their adventures or provide the experiences they previously loved.

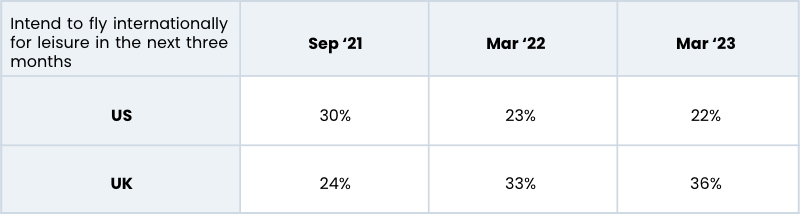

Shifts in the landscape have created new dynamics around cost and risk that consumers are factoring into travel. Considerations include destination-related health risks, travel insurance premium hikes, and accommodation and transportation cost increases, particularly for international travel. For example, international leisure travel has bounced back more quickly in the UK than in the US.

Popular culture is also playing a role in influencing aspirations. A great example is the interest that the streaming drama hit ‘The White Lotus’ had on interest in traveling to the destinations featured in the shows. According to Google, searches soared for the destinations and hotels where each season was filmed. For example, searches for the first season’s Hawaii resort rose 120% from six months prior. And after the second season aired towards the end of 2022, searches for the hotel in Italy increased 28X compared to six months before. While this example is specific, it highlights the importance of piggybacking on popular culture to build awareness and interest.

The opportunity for travel players is to understand these new decision dynamics and figure out how to leverage these changes to get on the consideration list. That requires digging into how your segments’ decision-making process has evolved by re-assessing your data or conducting new research. Unless you are clear on your key audiences and how they make decisions, you’ll be wasting marketing spend or leaving money on the table.

3. Communicate with empathy

All great marketing is born of a strong, clear strategy. And that starts with diagnosis and understanding who you are targeting and how you are positioning your brand to them. Travel and tourism marketing is full of great examples of campaigns that get inside the heads of their audience and play to their needs, desires, and aspirations.

Think Tourism Queensland’s ‘The Best Job In The World,’ Airbnb’s ‘Live There’ campaign, or even Portugal’s pandemic placeholder ‘Can’t Skip Hope.’ All do a great job of integrating the needs of their specific target audience into the fabric of the story.

But this isn’t always easy, especially for national tourism bodies or airlines where the nation scrutinizes the outputs! But that’s where effective market research is critical. It can fuel a strong strategy and provide the guidance to support effective execution. Taking the time to get under the skin of your audience through data analysis, qualitative research, and quantitative validation will ensure your strategy is commercially viable. Then, before you invest in it, communications pre-testing will provide the confidence that a campaign will work, and brand tracking will help optimize your impact when in the market.

As Susan Coghill, Tourism Australia’s Chief Marketing Officer, eloquently put it in travel weekly;

“Ultimately, what Australians think of the campaign is of little real importance. Rather whether we can see our visitation numbers from high-spending markets is all that matters.”

4. Plan for cultural nuances

When researching multiple markets, you must consider more than just language barriers. You must allow for cultural nuances in your research approach, both in the line of questioning and in the interrogation of results. We can all think of advertising translation fails, but you shouldn’t get that far if you’ve done your research correctly.

There are two key things to remember here. The first is to translate your survey and pilot it in the market before you scale the research to ensure that you are asking what you think you are and that the survey instrument is providing the kind of actionable insights you seek.

Platforms like Glow make this easy with in-built instantaneous survey translation, enabling you to translate and then share your survey with language experts in-market who can tweak the survey in-platform. That saves time and money versus traditional translation services and ensures survey logic consistency to ensure comparability of results at the end of the process.

Tourism Australia recently used Glow to get an early read on consumer response to its latest Global campaign, ‘Come & Say G’day,’ across five international markets in multiple languages, with the insights helping the marketing team further refine its go-to-market strategy.

The second is to pilot before you scale. Capture the opinion of 100 respondents, then assess whether the data looks right and provides sensible coherent answers and patterns.

5. Identify social and environmental motivations.

Emerging trends in travel and tourism are the impact of environmental and social considerations. Data from Deloitte suggests that 40% of global travelers try to travel sustainably, with expenditure on sustainable tourism expected to grow at 15% CAGR for the remainder of this decade.

Consumers are making changes and expect the tourism industry to do better. Catalyst data highlighted that two in three Australians expect the tourism industry to positively contribute to communities and natural places.

It makes sense; the fallout from Covid and the climate crisis has focussed our attention on the world around us and encouraged sustainable travel practices that minimize negative impacts and promote positive social and environmental outcomes. This can include promoting eco-friendly accommodations and activities, supporting local businesses and communities, and engaging in responsible tourism practices such as reducing plastic waste and conserving natural resources.

Palau’s Pledge campaign effectively turns these concerns into a compelling marketing vehicle for the tourism-dependent island nation. These considerations are increasingly important for many travelers and must be assessed when defining your target audience and your go-to-market messaging.

This applies not only to eco-credentials but to social and ethical considerations. For example, there has been a +25% YOY increase in global searches for ‘LGBT travel’ according to Google. It starts with knowing what consumers think of your current performance so that you can identify risks or opportunities.

The Wrap

As the market bounces back, now is the time for travel and tourism providers to take action, to capitalize on the emerging opportunities that a changing market offers.

If you would like a free copy of our ebook of travel and tourism case studies, or want to speak directly to someone to learn how Glow can support your decision making, then book an intro with our experienced team.

Oscar Mora

VP, Business Development | APAC